Montreal-based PSP Investments, which manages $243 billion in pension plan assets for federal government employees, is gearing its investment strategy toward an economic scenario of “mild recession” and “more persistent than expected” inflation in financial markets .

And this, while PSP has just closed its 2023 financial year with a return of 4.4% over one year. This return is much higher than that of its benchmark portfolio “despite a particularly difficult environment, both for equities and for bonds”.

But for its new fiscal year, the management of PSP prefers to maintain moderate expectations due to a still worrying macroeconomic context.

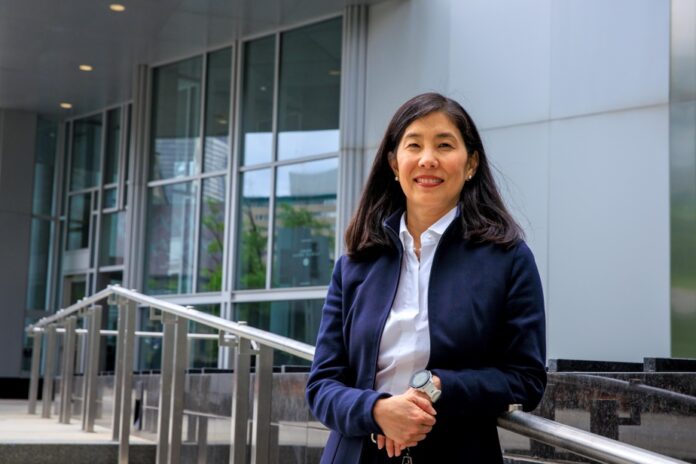

“We anticipate mild recessionary conditions in developed economies within a year. We also expect inflation to be more persistent than financial markets anticipate, and therefore interest rates to remain elevated for some time,” said Deborah K. Orida, President and Chief management at PSP during an interview with La Presse, Wednesday, on the occasion of the announcement of the annual results of PSP.

In this regard, and eight months after taking office as President of PSP, Ms. Orida is very satisfied that in “a particularly difficult environment, both for equities and for bonds, PSP has achieved a return of 4, 4% for its fiscal year 2023 and outperformed its benchmark portfolio.”

In his opinion, this result reflects several characteristics of the company: “the resilience of our diversified portfolio, the quality of our team and our entrepreneurial spirit which have allowed us to stand out in the market in the sectors of infrastructure investments, natural resource investments and private credit [financing]. This pioneering spirit and brilliant execution is what PSP’s past performance will be even more defining in the years to come.”

In the opinion of Eduard van Gelderen, Senior Vice President and Chief Investment Officer at PSP, the “strategy of private market diversification and international growth has been essential to maintaining stability at the heart of the exceptionally volatile financial markets”.

From its administrative headquarters in Montreal, and its international offices located in London, New York and Hong Kong, PSP manages assets of up to 243 billion which are distributed at 60% in North America, and in similar shares of approximately 17% of the side of Europe and Asia-Pacific.

– Capital markets (equities, bonds): 0.3% to 98.5 billion

– Private placements: 3.3% to 37.2 billion

– Real estate investments: 0.2% to 32 billion

– Infrastructure investments: 19% to 29.4 billion

– Debt securities (financing): 13.1% to 26.1 billion

– Investments in natural resources: 10.9% to 12.3 billion