The ongoing drama at Gildan is surprising, particularly because it is rare to see a board of directors reveal so much information surrounding discussions held behind closed doors.

Almost every day brings its element of surprise since the dismissal of the founder and CEO of the Montreal clothing manufacturer two weeks ago.

This crisis is reminiscent of similar situations in the past, including one in the fall that resulted in the dismissal CEO returning to his position.

Fired on November 17, OpenAI co-founder Sam Altman was back in the saddle less than a week later… with a revamped board of directors.

Another entrepreneur who was put in a similar position was Apple co-founder the late Steve Jobs. Fired by the board of directors in the 1980s, he returned to lead Apple around ten years later.

The reasons and context leading to the dismissal of a founding CEO differ from one case to another.

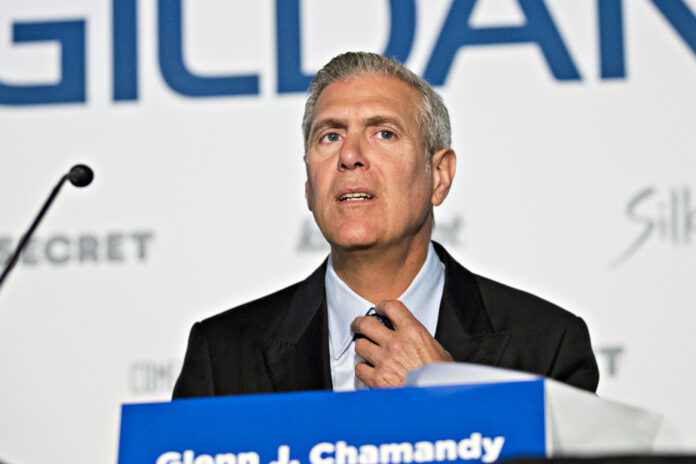

In the case of Gildan, the board fired Glenn Chamandy on December 10 and justified its decision by differences related to the succession plan. But also by maintaining that Glenn Chamandy wanted to move forward with a multi-billion dollar acquisition strategy in sectors adjacent to the company’s main field of expertise which is manufacturing.

Vince Tyra has been named to succeed Glenn Chamandy under a “planned and considered” succession process. Board Chairman Donald Berg and Vince Tyra are both Kentucky residents with strong ties to the University of Louisville. Donald Berg sits on the board of supervisors of the University of Louisville while Vince Tyra was director of intercollegiate sports at this university from 2017 to 2021.

A dozen major institutional shareholders, together controlling more than a third of Gildan’s shares, have so far publicly opposed the board’s decision.

Time will tell whether or not Glenn Chamandy will return to his position as CEO and whether the board of directors will remain intact or undergo major changes.

Gildan gave up its multiple voting shares in the early 2000s when Glenn Chamandy succeeded his brother Greg at the helm of Gildan.

“Control was then abandoned,” says François Dauphin.

The president of the Institute on Governance recalls that the role of shareholders is to elect and choose directors to represent them in order to determine the direction of the company.

He then adds that the group of dissident institutional shareholders voted barely six months ago in favor of all the directors currently in office who decided to fire the CEO.

This specialist wonders why shares with multiple voting rights were abandoned if there was still a desire to control the destiny of the company.

However, some observers will not be surprised to see long-time shareholders lining up behind Glenn Chamandy and supporting his return since these dissident shareholders have potentially developed a personal relationship over the years following multiple meetings and quarterly conference calls. Glenn Chamandy had been CEO for around twenty years.

It cannot be ruled out that the crisis will lead to a proxy battle leading to a shareholder vote at an extraordinary meeting.

This eventuality would, however, risk stretching the crisis over several weeks, or even several months. Gildan employees, customers, suppliers and shareholders have every right to fear that a prolongation of the crisis will cause a distraction that could harm the company.

Behind the scenes, observers have no shortage of scenarios to try to anticipate what may happen if instability persists.

There are also whispers that foreign private manufacturing companies (Chinese and Mexican, for example) might want to acquire a manufacturing base like that of Gildan.

It could even be part of a strategy by the board of directors to try to calm things down. By seeing if there could be companies interested in the company, the board of directors could calm the discontent among shareholders. dissidents could be more docile.

Gildan’s stock has fallen since the start of this series, but it has not collapsed and remains higher than at the start of the year. A more pronounced upward or downward movement is to be anticipated depending on the scenario that will resolve the crisis.

Until then, whoever manages to convince their portfolio manager to invest in Gildan in such an uncertain context will be very smart.