A year ago, the outlook for the tech industry looked bleak. Google’s profits were plummeting. Shares of Meta, Facebook’s parent company, were in free fall. Amazon’s business growth had slowed to its lowest level in 20 years.

But what looked like an industry-wide meltdown appears to have been more of a correction. The last quarter was surprisingly good for the biggest tech companies. Meta and Google’s advertising business rebounded. Microsoft’s cloud computing business continued to grow. The same goes for Amazon e-commerce. Apple is the only major tech company whose revenue has shrunk.

This fall exposed a weakness: the tech giants haven’t developed a new big idea in years. Although they have invested in self-driving cars, metaverse and quantum computers, these companies still depend on selling digital ads, iPhones and cloud computing.

Today, companies are hoping that artificial intelligence (AI) will be the answer to the problem and a way to refresh aging product lines that haven’t evolved much in recent years. They plan to invest billions in generative artificial intelligence technology, which powers chatbots such as ChatGPT.

During a conference call with investors last Thursday, Andy Jassy, CEO of Amazon, said that work on generative AI was still in its infancy, but he said it “is going to be transformative, and […] it will transform virtually every customer experience that we know of.”

Apple CEO Tim Cook made similar comments the same day. In recent meetings with analysts, Google, Meta and Microsoft also said they would increase their investments to support AI work.

For observers like Stacy Rasgon, an analyst at Bernstein who has covered the chip industry for 15 years, the increased spending to support AI development is reminiscent of investments in servers in the late 1990s and in data centers. data in 2010. According to consulting firm McKinsey, generative AI is expected to generate more than $2 trillion in economic benefits by increasing productivity in many industries.

Generative AI products are just starting to hit the market. Microsoft plans to charge $360 per year for Microsoft 365 Copilot, an AI-powered assistant for Word, Excel, and PowerPoint. According to analysts, it will be necessary to wait until next year to know the amount of new sales generated by this product.

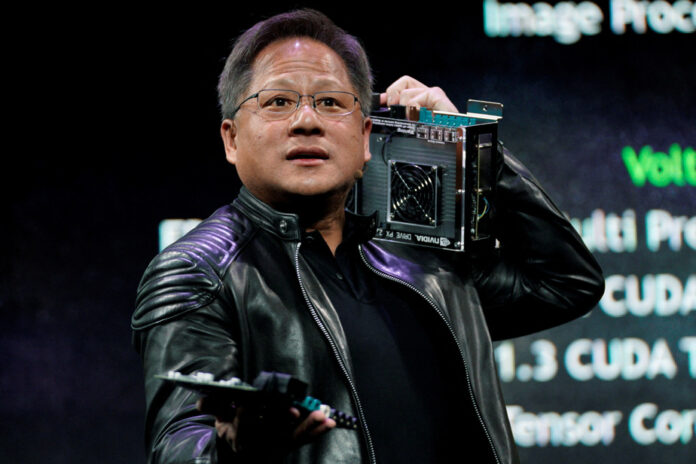

This leap reflects the increase in demand for the graphics processing units (GPUs) it designs to power artificial intelligence technologies. Nvidia has no serious rivals in this market.

“It seems like everyone and their dog is buying GPUs,” Elon Musk said at an event in April, as he discussed his plans to start an AI-focused company.

Nvidia’s data center business is expected to double sales this year to $15 billion. According to Bernstein Research, it should generate $20 billion in additional revenue next year.

Nvidia’s share price has tripled this year, making the company one of the few companies with a total value of over $1 trillion.

Nvidia anticipated the AI boom. For years, Jensen Huang, CEO of the company, has talked about how GPUs would power AI technologies. He was so convinced of this that he told analysts in 2017 that the company was “all in” on a single-chip design.

“Everything will work out, or it will work out terribly,” Huang said.