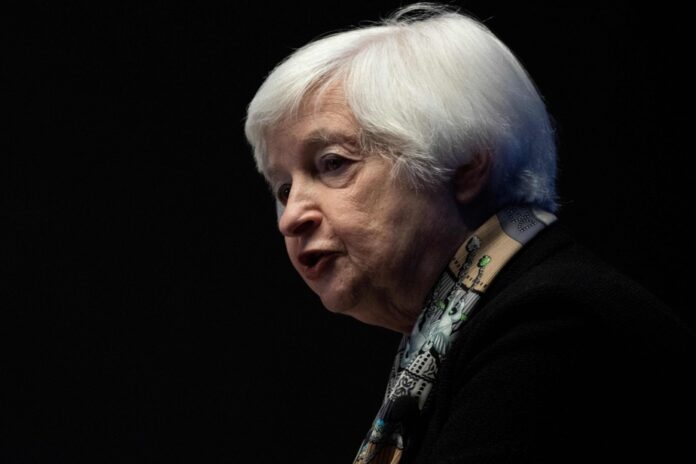

(Washington) The reform of the World Bank (WB) should allow it to lend an additional 50 billion dollars over ten years to countries in need, US Treasury Secretary Janet Yellen told AFP in an interview. exclusive.

Thanks to this development, the WB “expands its financial capacity”, said Joe Biden’s Secretary of Economy and Finance, as the spring meetings of the IMF and the World Bank take place on Monday in Washington.

The changes “could result in an additional $50 billion in lending capacity over the next decade, … a significant increase in resources,” she said, noting that this represented “a 20% increase in IBRD sustainable lending level”, the International Bank for Reconstruction and Development, a subsidiary of the World Bank.

Announcements will be made next week at the spring meetings of the International Monetary Fund (IMF) and the World Bank, she said.

This reform of the World Bank was launched in October, under the impetus of certain member countries, in particular the United States. At almost 80 years old, the institution, which emerged from the Bretton Woods conference of July 1944, at the end of the Second World War, must indeed better meet the financing needs of developing countries.

And beyond the amounts, the World Bank will see its mission updated, “to add the strengthening of resilience against climate change, pandemics, conflicts”, underlined Janet Yellen.

“These challenges are not separate or contradictory, but rather inextricably linked,” she insisted, and another announcement is expected at the IMF and World Bank Spring Meetings: “The Bank’s operating model will be updated to direct it towards the goals we set for ourselves”.

“That includes a variety of things,” the secretary detailed, referring to “integrating global challenges into diagnostic tools, country partnership strategies or the results-based framework and creating more incentives for the mobilization of national and private capital”.

The other development banks should then also begin their transformation.

In parallel, the World Bank will also change its president by the end of June, after the resignation of David Malpass. The lack of consideration of climate change had often been criticized.

Janet Yellen praised the “strong foundation” provided by David Malpass.

“I guess Ajay Banga will be elected president, and he will continue this process. And I believe he understands how managing these global challenges is inextricably linked to ending extreme poverty, and will show an ability to steer the World Bank in a new direction,” she said. .

Another important topic to be discussed in Washington next week is the restructuring of sovereign debt for poor countries, which had borrowed to meet COVID-19-related expenses, and are now seeing interest rise as rates rise.

“There will be a Global Sovereign Debt Roundtable meeting next week,” commented Janet Yellen.

Among the main creditors is China, which is accused of a lack of will to successfully restructure these debts. However, “we have seen some movement from China regarding participation in Sri Lanka’s debt restructuring, which is a hopeful sign,” the Treasury Secretary said.

“We have technical discussions” in which the Middle Kingdom “has participated”, she said, assuring that the countries continued “to pressurize China for improvements”.

Economic support for Ukraine will also be discussed.