(San Antonio) A US central bank (Fed) official on Friday favored one or more additional rate hikes, saying that with inflation remaining far too high, “monetary policy needs to be tightened further.”

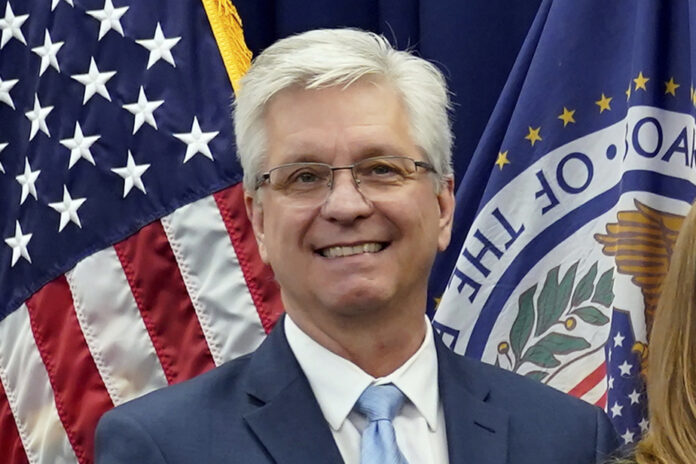

“The labor market remains strong and quite tight, and inflation is well above target, so monetary policy needs to be tightened further,” said Christopher Waller, one of the US Federal Reserve Governors. .

He also judges that “monetary policy will have to remain restrictive for a substantial period of time and longer than the markets anticipate”, meaning that rates could remain high for longer than expected.

“But there are still more than two weeks until the next FOMC meeting, and I’m ready to adjust my stance based on what we learn about the economy, including conditions. loans,” he added.

The crisis in the banking sector could indeed have led to more difficult access to credit for households and companies, which would lead them to postpone certain expenditure and would thus have the same effect as an increase by the Fed in its main key rate. .

“It is unclear to what extent the strains in the banking system will weigh on economic activity. If banks feel they need to adjust their business models or are uncertain about the stability of their deposit base or the dynamics of the economy, they can tighten credit conditions and reduce lending,” noted Christopher Waller .

“It is important to note that there were signs of tightening credit conditions this year before the problems appeared in the banking system,” he noted, however.

Christopher Waller also clarified that the regional branch of the Atlanta Fed anticipated GDP growth of 2.2% in the first quarter, stronger than initially expected.

This “would mean that, so far, tighter monetary policy and credit conditions are doing little to restrain aggregate demand,” he said.

Inflation in the United States slowed to 5% year on year in March, the lowest in almost two years, according to the CPI index published on Wednesday.