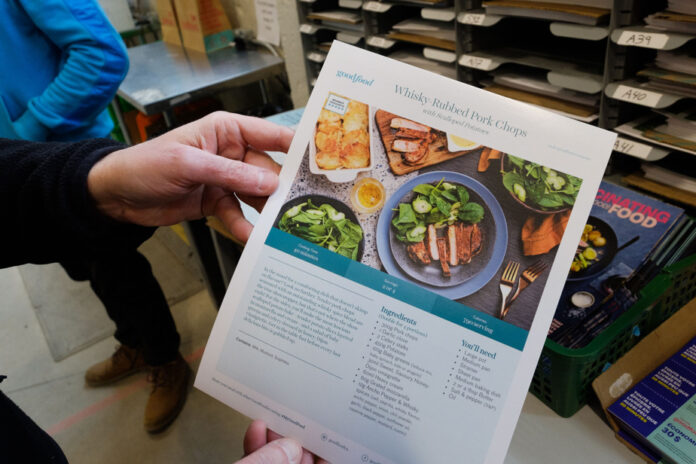

Losses of customers, falling sales and a decline in the stock market… Despite headwinds, Marché Goodfood shows an improvement in its financial results, the specialist in ready-to-prepare meals focusing on its highest paying customers.

The context remains difficult for Montreal society at a time when consumers are closely monitoring their food spending and when the enthusiasm for online commerce is fading compared to the peak reached during the pandemic.

The company continued to lose customers and saw sales decline nearly 26% in the fourth quarter ended September 2. However, the company manages to protect its margins while it focuses on its best customers.

“We continue to see a deterioration in economic conditions that are having an effect on consumers, but also suppliers,” says President and CEO Jonathan Ferrari during a conference call on Wednesday.

The loss of customers largely explains this decline. The company served 116,000 active customers, compared to 157,000 during the same period last year. However, the trend seems to be slowing down since the company has only lost 3,000 customers in the last three months.

Desjardins Capital Market analyst Frederic Tremblay points out that the loss of 3,000 customers occurred during the summer season. “Demand is weaker during the summer,” he emphasizes. We believe seasonality played a role in the decline. »

Still, Goodfood narrowed its net loss from $58 million to $4 million in the fourth quarter. The gross margin, for its part, also improved, going from 28.3% to 38.2%.

The company is also burning less cash with a cash loss of 1 million, compared to 12 million in the same period last year.

Goodfood changed its strategy last year, focusing on reaching profitability more quickly rather than increasing the number of subscribers. It also abandoned its online grocery service.

Goodfood shares fell 5 cents, or 12.25 per cent, to 36 cents Thursday on the Toronto Stock Exchange.