Members of Gildan’s management team sold millions of dollars worth of shares in the Montreal clothing maker last week after the firing of founder and CEO Glenn Chamandy.

Manufacturing top executive Benito Masi sold $5.5 million worth of shares following trades during sessions Wednesday, Thursday and Friday.

Finance chief Rhodri Harries made a gross gain of more than US$6.5 million from exercising options. He made his trades during the sessions of Tuesday, Wednesday, Thursday and Friday last week.

Chuck Ward, head of marketing, sales and distribution, sold $930,000 worth of stock on Thursday.

Finally, Michael Schroeder, Vice President of North American Sales, sold 3,092 shares mid-week.

It was not possible to speak to them on Monday. A Gildan spokeswoman, however, indicates that “most” of these executives – without specifying which ones – had indicated to the company their intention to make transactions before knowing that Glenn Chamandy was leaving the company.

The spokesperson adds that there was a “reduced” window during which it was possible for these leaders to compromise in December. “This trading window will only be reopened at the end of February. The options exercised were part of a normal vesting schedule during which managers have the opportunity to manage their personal finances. »

The spokesperson specifies that all the executives who sold shares last week remain significant investors in the company.

In an interview on Sunday, Luc Jobin, member of the board of directors of Gildan and former CEO of CN, affirmed that Glenn Chamandy had sold “virtually all of his shares in Gildan” last week the day after his dismissal.

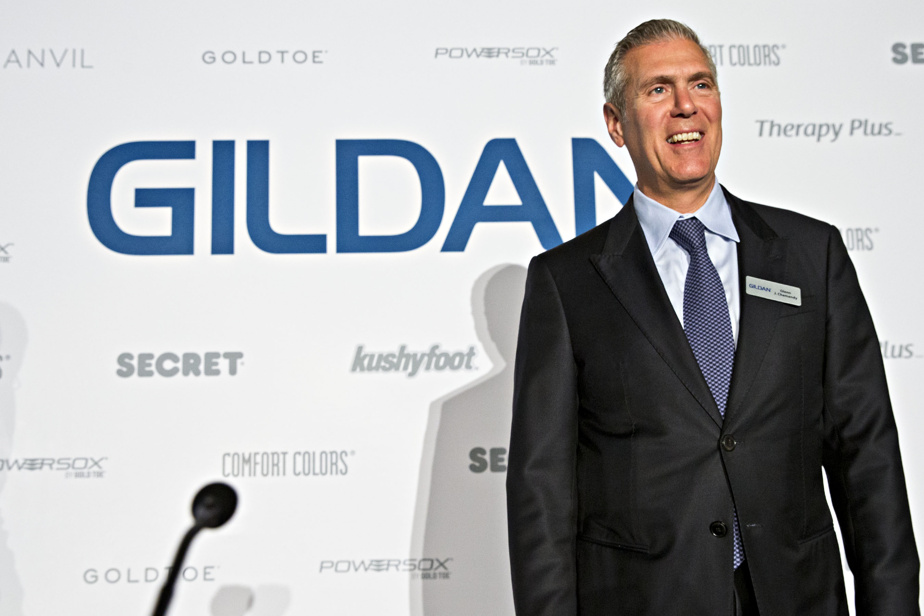

Glenn Chamandy was shown the door early last week by the board, which appointed Vince Tyra to take over. The departure of Glenn Chamandy was then simply explained by a disagreement over the timing of the implementation of the succession plan.

In turn, institutional shareholders Turtle Creek, Browning West, Jarislowsky Fraser and Pzena Management criticized Gildan’s decision last week.

In his interview with La Presse on Sunday, Luc Jobin said that Glenn Chamandy had served a calculated ultimatum to the board of directors, in addition to accusing Mr. Chamandy of wanting to make risky acquisitions.

“The council had to agree to two requests, otherwise it was going to leave,” said Luc Jobin. This administrator claims that Glenn Chamandy’s first request was to move forward with a strategy of multiple, multibillion-dollar acquisitions in adjacent sectors.

These acquisitions, according to Luc Jobin, would be “highly dilutive” for shareholders due to the debt and equity issues required to complete them. Luc Jobin also said that carrying out this strategy involved a risk because it requires skills that are not fully mastered by Glenn Chamandy.

Still according to Luc Jobin, the second condition set by Glenn Chamandy was to review in two years the development status of an internal candidate, but that Glenn Chamandy could not tell the board with certainty whether this candidate could reach the level necessary to succeed him. as CEO.

The board having responded to Glenn Chamandy that it had to complete its work of evaluating external candidates before taking a position, Luc Jobin maintains that the relationship with Mr. Chamandy then deteriorated quickly.

Glenn Chamandy denied Monday having given the board an ultimatum “regarding any potential acquisition strategy.”

“This is a diversion to distract from the shareholder reaction to the board’s handling of succession planning, in which I was not involved,” Chamandy said. in a written statement.

“I neither orchestrated nor controlled the events: the board led the process. It is essential that a leadership transition is conducted in a manner consistent with the success of Gildan. Preserving our talent, culture and expertise, which are the pillars of our success, is vital,” he continues.

US institutional investor Coliseum Capital – currently Gildan’s second largest shareholder with an approximate 6% stake – supports the board of directors and intends to increase its stake in Gildan by purchasing shares on the market to become the largest shareholder ahead Jarislowsky, which has a roughly 7% stake.

The board invited Coliseum co-founder and managing partner Chris Shackelton to join Gildan as a director.