Spouses Thomas*, 39, and Catherine*, 33, are both postdoctoral researchers in the biomedical sector.

Their income, which totals some $105,000 a year, comes from research work grants, accompanied by university lecturer contracts.

In the couple’s budget, this research grant income has the advantage of being tax exempt in Quebec, but not at the federal level.

In return, this scholarship income does not allow you to accumulate future pension credits with the Quebec Pension Plan (QPP), nor contributions that can be used in a personal RRSP with tax credit.

Nevertheless, Thomas and Catherine were able to take advantage of low-tax stock market income to build a good asset base.

For example, in May 2024 they purchased their first residential property (a condo in the city) for $420,000 with a good down payment that allowed them to obtain mortgage financing at a viable level despite rising mortgage rates. interest.

Thomas and Catherine also have tax-free savings accounts (TFSAs) which are quite well funded ($75,000 and $62,000 respectively).

On the other hand, their RRSP accounts remain very thin due to the absence of contributions eligible for the tax credit for scholarship income.

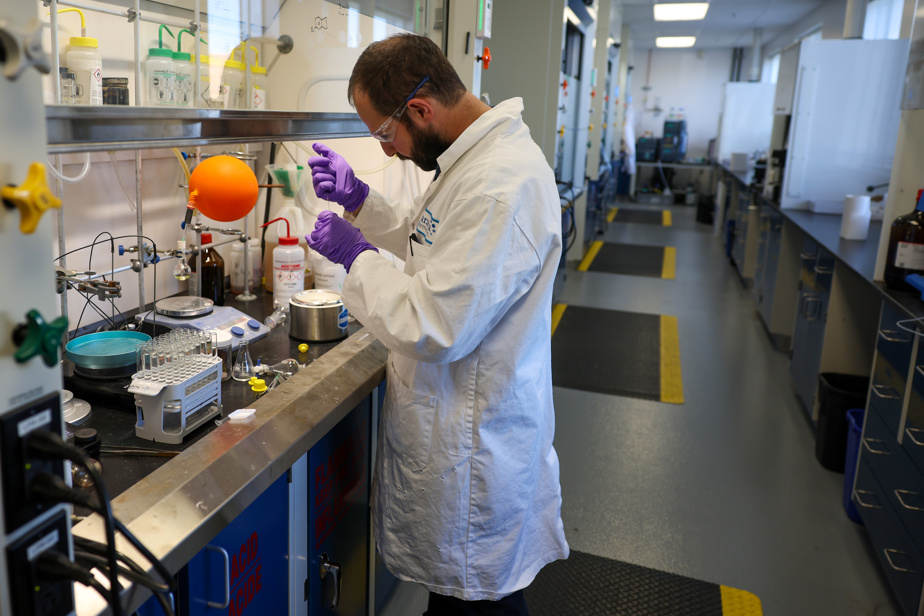

This situation will change in 2024 for Thomas, when he will move from scholarship income to employment income as a researcher in a biomedical laboratory in the Quebec public sector.

With this new job, Thomas will also begin his participation in the very solid RREGOP pension plan of the Quebec public sector.

But for Catherine, this transition from stock market income to taxable employment income is planned in five years, by 2028.

Until then, Thomas and Catherine plan to maintain their reasonable lifestyle at around $66,000 per year, while continuing their savings habits (approx. $20,000 per year) in their registered TFSA and RRSP accounts.

Also, the couple anticipates the arrival of a first child “in two to three years”, which could require replacing their small, aging vehicle with a more recent model better suited to their new family needs.

Thomas and Catherine are seeking advice on upgrading their financial planning and tax optimization priorities over the coming years.

Among other things, Thomas asks during an interview with La Presse, “because we have hardly contributed to retirement plans (QPP, personal RRSP), how could we estimate our retirement income at age 65? “.

And until then, Thomas adds, “how do we organize our financial planning priorities over the 25 to 30 years of employment income we anticipate between now and retirement? “.

“How can we properly distribute our savings capacity between our RRSPs, our TFSAs, or accelerated repayment on our mortgage loan, while taking into account medium and long-term financial and tax considerations? »

The situation and questions from Thomas and Catherine were submitted for advisory analysis to David Paré, who is a financial planner and investment advisor at Desjardins Wealth Management in Quebec.

From the outset, David Paré compliments the “well-established savings habits” and reasonable lifestyle of Thomas and Catherine during their final years of training and at the start of their careers as researchers.

“Thanks to their good budgetary discipline, they already have assets with a net worth approaching $300,000, including their registered accounts (RRSP, TFSA) and the right down payment when purchasing their first property residential,” underlines Mr. Paré.

“In fact, if Thomas and Catherine keep their savings budget around $20,000 per year, and divided into various types of accounts over the years, that should allow them to be in a good financial situation when they retire in about thirty years old. »

That said, David Paré has prepared a step-by-step financial planning process for them to guide them in achieving their medium and long-term goals.

As Thomas will soon move from scholarship income to salaried employment income as a researcher, he will be able to contribute to solid retirement plans – the Quebec public sector RREGOP and the Quebec Pension Plan – while beginning to benefit from credits tax for contributions to his personal RRSP.

For his partner Catherine, this transition is planned in five years, around 2029.

So, until Thomas obtains his first tax assessment notice with an amount of RRSP contributions, expected in 2025 for the 2024 tax year, David Paré recommends that spouses maximize contributions to their respective TFSAs in 2024 and in 2025, $7,000 per year each or $14,000 total.

As for the remaining $6,000 portion of their $20,000 annual savings budget, David Paré advises them to establish a savings reserve for the replacement of their vehicle, scheduled in five years.

The second stage of the financial journey prepared by David Paré is planned for 2025 to 2030, with the first years of taxable employment income for Thomas and the last years of scholarship income for Catherine.

With their same savings budget at $20,000 per year, Mr. Paré recommends that Thomas maximize his available contributions to his personal RRSP – which he estimates at $3,000 per year – in order to generate a “tax return » estimated at around $1200 per year which could be used as a prepayment on the residential mortgage.

As for the remaining portion of their savings budget, approximately $3,000, Thomas and Catherine should deposit it into their savings reserve for the replacement of their vehicle.

In the meantime, if Thomas and Catherine carry out their plan to have a first child, this savings budget of $3,000 per year should instead be directed to their child’s education savings account (RESP).

“This is how they will be able to quickly benefit from the tax subsidy of around 30% on the first $2,500 of annual contribution to their child’s RESP. And this, until his 17th birthday and the start of his post-secondary studies,” points out David Paré.

The third stage of the financial journey suggested to Thomas and Catherine would begin in 2029, which is the year of the start of salaried employment in research envisaged by Catherine.

Like Thomas, five years earlier, Catherine will then begin to accumulate employment credits with the RRQ, as well as retirement plan contributions linked to her new job.

David Paré notes that if it is a job in the private sector, with a group RRSP as a retirement plan, Catherine could end up with a good amount of contributions that can be used in her personal RRSP.

“By adding this amount to that of Thomas, I arrive at a total estimate of around $13,000 for the couple,” explains David Paré.

Such an amount of eligible contributions to their personal RRSPs would then be prioritized in the couple’s $20,000 annual savings budget.

Especially since these contributions would then earn them “tax refunds” which David Paré estimates at around $4,800 per year and which could then be used as additional payments on their mortgage loan.

“This would happen around 2040, that is to say a few years before Thomas and Catherine start retirement, with the advantage of a lifestyle budget relieved of mortgage payments. »

As for the remaining portion of their annual savings budget, which David Paré estimates at around $7,000, he recommends that they first contribute to their child’s RESP at the annual maximum eligible for the tax subsidy.

Secondly, they will be able to contribute to their respective TFSAs according to their available savings capacity.

“By following the broad outlines of this financial journey, while maintaining a reasonable lifestyle, Thomas and Catherine could envisage their retirement in good financial health,” indicates David Paré.

“Even though they could have enough financial assets in their personal RRSPs and TFSAs as sources of income at the start of retirement in order to be able to delay the start of public pensions (QPP, federal PSV) beyond their 65th birthday, and then benefit from enhanced pensions until the end of their life. »