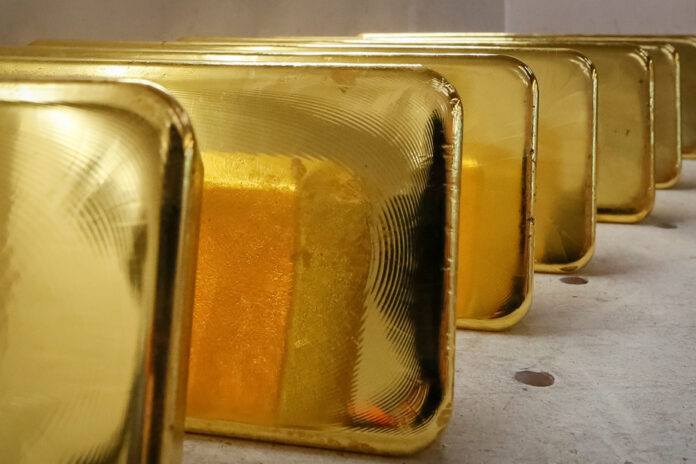

(LONDON) The price of gold, propelled by growing concerns about the banking sector after the takeover at a knockdown price of the Swiss giant Credit Suisse, exceeded the symbolic threshold of 2,000 dollars an ounce on Monday.

As the shares of the big banks plunge on the stock market on Monday after UBS’s takeover of Credit Suisse, investors fearing a chain reaction are falling back on gold, a traditional safe haven.

The yellow metal gained some 0.33% to 1995 dollars in the morning around 6:15 a.m. (Eastern time), after rising to 2009.73 dollars, a high for a year.

Since the bankruptcy of the American Silicon Valley Bank (SVB) ten days ago, the price of gold on the financial market has risen by almost 9%.

Gold had crossed the $2,000 mark only twice: in August 2020, in the midst of the COVID-19 pandemic, when it hit an all-time high of $2,075.47, and in March 2022, during the first weeks of Russia’s invasion of Ukraine.

Gold is “very attractive at a time when holders of large accounts at failing banks are wondering how much they will be able to recover,” said Rupert Rowling, analyst for precious metals buying platform Kinesis Money, in a note.

In addition, investors are wondering if the central banks, which have been raising their rates for many months to fight inflation, will not be forced to slow down because of the damage they are causing to the banking sector.

In this scenario, lower key rates despite still high inflation could still benefit gold.

Other assets, which had benefited for years from low rates and the influx of liquidity on the market, but suffered in recent months from monetary tightening, and therefore soared in recent sessions, like the giants technology, and bitcoin.

It has “a strong correlation to tech stocks, and is up 45% from its March low,” comments Ipek Ozkardeskaya, analyst at SwissQuote.

Bitcoin gained more than 5% again over the weekend to hit $28,456 on Monday, its highest since June 2022.

But the volatile cryptocurrency remains down nearly 60% from its all-time high reached in 2021 at $68,992.

“It is clear at this time that bitcoin’s performance in a high rate environment remains strongly tied to Fed policy,” warns eToro analyst Simon Peters.

As with gold, the eyes of the market will therefore be on the American Federal Reserve, to see how the monetary institute will react during its meeting on Tuesday and Wednesday.