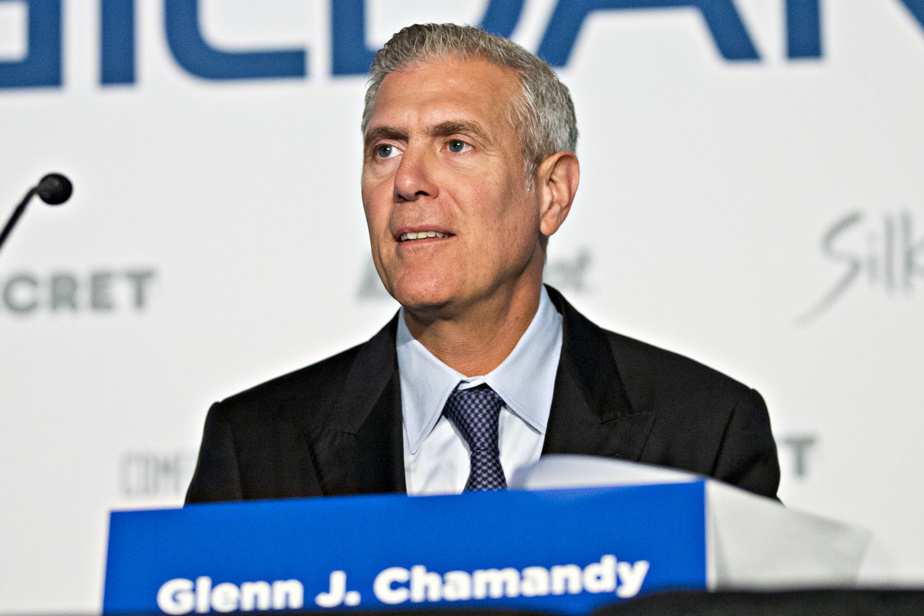

Pressure intensified Friday on Gildan’s board of directors to reverse its decision to bring Glenn Chamandy back at the helm of the Montreal clothing manufacturer.

At least four of Gildan’s 10 largest institutional shareholders are now arguing in favor of the return of Glenn Chamandy, who was shown the door on Sunday by the board of directors. The board appointed Vince Tyra, a 58-year-old American, to take over. He is scheduled to take office on February 12.

Gildan’s largest shareholder with a 7% stake, Montreal asset manager Jarislowsky Fraser, as well as New York firm Pzena Investment Management, in turn announced on Friday that they oppose the recent decision of the board of directors to fire Glenn Chamandy.

“Glenn Chamandy’s continued leadership is essential for the company to successfully execute its important expansion and innovation program,” says Charles Nadim, head of research and portfolio manager at Jarislowsky Fraser, in a written communication sent to La Presse.

“The board’s press release regarding Vince Tyra’s background does not paint a fair picture for shareholders and the decision was not made with sufficient diligence in evaluating his performance. Vince Tyra has not worked in the apparel industry since 2005 and does not have the relevant manufacturing expertise, which is Gildan’s primary competitive advantage,” he adds.

Jarislowsky Fraser calls for the resignation of Board Chairman Donald Berg and urges the board to reinstate Glenn Chamandy as CEO of Gildan, “where he could continue to mentor internal candidates in establishing of a comprehensive succession plan that will result in an orderly transition of leadership of the company to ensure its long-term success.”

It was not immediately possible to obtain a reaction from Gildan.

On Thursday, Turtle Creek Asset Management, a Toronto asset manager and Gildan shareholder for a decade, and Browning West, a Los Angeles investment firm, sent a letter to Gildan’s board of directors to ‘urge to reappoint Glenn Chamandy as CEO.

Jarislowsky Fraser, Turtle Creek and Browning West are among Gildan’s 10 largest shareholders.

In an interview with La Presse earlier this week, the chairman of the board, Donald Berg, explained the departure of Glenn Chamandy by a divergence on the timing of the implementation of the company’s succession plan.

Donald Berg stressed Monday that the timing is right for a change because the company is doing “very well, gaining market share and has a good plan in place for the next few years.”

Donald Berg says he tried in vain to reach an agreement with Glenn Chamandy on when he would retire in order to achieve a smooth transition.

Glenn Chamandy said Monday he was not granting an interview, but said he found it “regrettable” that his vision for the future differed from that of other board members and that the company was ending to his employment contract “without reason”.